WD-40 Company : Keep in the toolbox not in the portfolio

WD-40 is a well recognized trademark, however the stock seems overpriced

Summary

WD-40 Company is a leading provider of maintenance and home care products, best known for its flagship WD-40 formula, which has numerous practical applications. The company also boasts a broad product portfolio that it markets through third-party wholesalers and retailers worldwide.

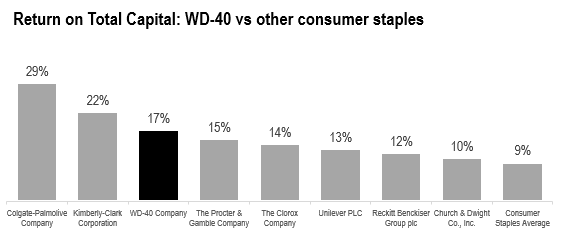

The WD-40 brand’s strong recognition is arguably the company’s primary competitive advantage. Its wide range of practical uses offers a compelling value proposition for customers, making it a household name across generations. This strong brand equity allows WD-40 to deliver returns comparable to those of major consumer staples companies like P&G, Unilever, Clorox, and Colgate.

The company's growth has been fueled by DIY and "ready-to-assemble" trends, as well as the expanding urban population in Asia-Pacific markets. However, its profitability has been impacted by supply chain constraints, as WD-40 outsources its manufacturing activities.

Despite the company’s potential and the likelihood of margin normalization, our stock valuation suggests that WD-40 is currently overpriced, with its market price reflecting expectations of higher growth or greater margin improvements than what our analysis supports.

About the company

Founded in 1953 as the Rocket Chemical Company, the firm initially developed a water displacement formula for aerospace applications. Due to the product's success, the company decided to commercialize it for home use under the WD-40 brand. In the 1970s, the company changed its name to WD-40 Company, and since then, it has expanded by opening commercial offices in major markets and acquiring other brands to diversify its product portfolio. Today, WD-40 remains the company's most successful product, available in multiple formats and sold worldwide.

WD-40 Company's business model is straightforward: it focuses on commercial, marketing, research and development activities while outsourcing manufacturing to third parties globally. The company's day-to-day operations primarily involve engaging with distributors and retail operators, such as Home Depot and Lowe's, and developing new products to meet market demands. WD-40 distributes its products not only to DIY and big-box retailers but also to hardware, automotive, industrial, and hypermarket customers.

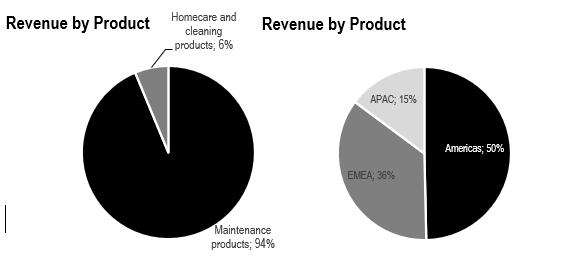

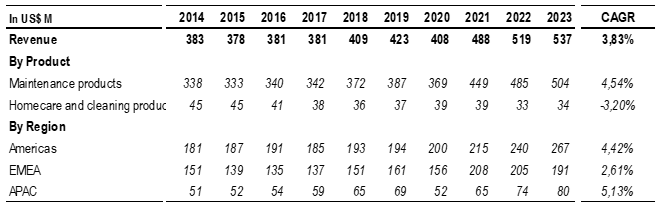

By the end of the fiscal year 2023, WD-40 Company reported revenue of $537 million. Approximately 94% of this revenue came from maintenance products, with the remainder from homecare and cleaning products. Geographically, revenue distribution was fairly balanced, with over 49% from the Americas, 36% from EMEA, and 15% from APAC.

WD-40 Competitive advantage

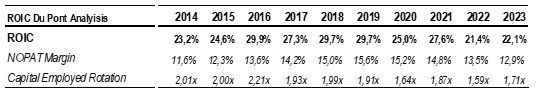

WD-40 Return over Invested Capital (ROIC) has been consistent and yielding at an average of 26% during the last ten years, surpassing its Weighted Average cost of Capital (WACC) by 18 basic points, clear sign of value creation and evidence of potential competitive advantages.

We believe WD-40's competitive advantage primarily stems from its strong brand recognition. As one of the most iconic products for preventing rust and corrosion, WD-40 is a staple in many households and workplaces. It's common to find WD-40 cans in garages and toolboxes, often passed down from one generation to the next. The brand's widespread recognition is bolstered by fan videos and tutorials online, showcasing the product's versatility and numerous applications. According to the company, the WD-40 formula boasts over 2,000 uses, contributing significantly to its popularity and utility.

Like Coca-Cola's recipe and KFC's chicken formula, the WD-40 formula is not patented; instead, it is protected as a closely guarded corporate secret, known only to a select few. This strategy allows the company to maintain exclusive control over the formula without the risk of patent expiration, which could invite competition. Consequently, it's challenging to find a global substitute or competitor brand that matches WD-40's formula. Most of its competitors are local brands that do not enjoy the same level of recognition.

This competitive advantage is reflected in WD-40's financial metrics, particularly its high return on invested capital, which is comparable to other leading consumer staples companies such as Procter & Gamble, Unilever, and Clorox. This strong financial performance underscores the company's ability to leverage its brand and product exclusivity effectively.

On the sourcing side, WD-40 faces challenges due to its limited negotiation power and its dependence on a small number of third-party contract manufacturers and component suppliers. Key inputs include certain chemical components and cans made from petroleum derivatives and tin, materials subject to significant market fluctuations. Factors such as supply and demand imbalances, geopolitical events, and economic conditions can impact the availability and cost of these materials.

The company acknowledge this on its 10- k risk section:

“….In particular, the COVID-19 pandemic, extreme weather events and other macroeconomic factors have resulted in significant supply chain constraints and transportation disruptions at times. Some of the challenges that we have experienced include general aerosol-related production capacity constraints and competition for such capacity by other companies who utilize the same third party manufacturers for their aerosol production. These challenges have periodically resulted in us not being able to meet the demand for our products by customers and end-users in certain markets where demand for aerosols has, for certain products, outpaced the available production capacity in the region….”

“…For example, the COVID-19 pandemic resulted in global supply chain constraints and transportation disruptions that led to increased competition for freight resources, higher fees charged by our third-party manufacturers, increased raw material costs and other input costs that negatively impacted our results of operations. In addition, other macroeconomic factors have resulted in an inflationary environment that has compounded these impacts and led to further increases in raw material costs, manufacturing and distribution costs, and other input costs….”

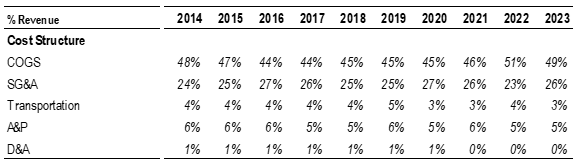

These dependencies can constrain WD-40's ability to fulfill customer orders efficiently and can lead to increased costs. For instance, the post-pandemic supply chain disruptions and the geopolitical instability resulting from the war in Ukraine have led to rising costs for the company. This is evident in the increase in the cost of goods sold, which rose from 45% of revenue in 2019 to 50% in 2023. These challenges highlight the vulnerabilities in WD-40's supply chain and the potential financial impact of external market conditions.

Management & Ownership

WD-40 is led by Steve Brass (57), a seasoned veteran who has been with the company since 1991. Throughout his tenure, Brass has held several key leadership roles, including Chief Operating Officer (COO), and has been a significant driver of the company's growth. In 2022, he was appointed CEO. His current compensation is closely tied to stock performance, and he holds equity in the company valued at over $5 million, according to Morningstar. Brass's leadership team comprises a blend of functional area heads and regional directors responsible for various markets and regions.

WD-40's Board of Directors consists of 11 members, 10 of whom are independent, with Brass being the sole non-independent director. The board is chaired by Gregory Sandfort (68), a veteran in the retail sector with extensive leadership experience in home improvement chain stores. Sandfort has served as a director of WD-40 since 2011. The other board members bring a wealth of experience from the hardware, construction, and consumer staples industries. Like Brass, board members' compensation is heavily linked to stock awards.

The company operates with four committees: Audit, Compensation and People, Corporate Governance, and Finance. The Audit and Finance Committees are chaired by Daniel Carter (67) and Trevor Mihalik (57), respectively—both professionals with strong financial backgrounds. Anne Saunders (62), who has extensive experience in the consumer staples sector, chairs the Compensation and People Committee. The Corporate Governance Committee is led by Eric Ethart (67), who has held various leadership roles in the construction equipment industry.

No director or executive counts with a controlling stake in WD-40. The company is currently owned by institutional investors of which hold more than 91% of shares in the company followed by public and retail investors account for more than 8%.

Company performance

In 2023, WD-40 reported sales of $537 million, reflecting a compound annual growth rate (CAGR) of 3.8% since 2014. While the company does not disclose a detailed price-volume breakdown, it has managed to achieve organic growth each year—except for 2020—averaging 5% annual growth when removing foreign exchange impacts. Acquisitions have not significantly contributed to this growth during the period.

The company's revenue growth has been primarily driven by its Maintenance Products segment, which has grown at a 4.5% CAGR from 2014 to 2023. In contrast, the Homecare and Cleaning Products segment has experienced a decline, with an annual decrease of 3.2% over the same period. The disparity in performance between these segments can be attributed to several factors:

Maintenance Products: The rise in DIY (do-it-yourself) projects has significantly boosted sales in this category. Social networks and online streaming platforms have made tutorials widely available, encouraging people to undertake home improvement, automotive, and workspace projects. Additionally, the growing popularity of ready-to-assemble furniture, such as that sold by IKEA, has driven demand for toolkits and related products.

Homecare and Cleaning Products: This segment has struggled due to intense competition from major players like Procter & Gamble, Kimberly-Clark, and Unilever, making it challenging for WD-40 to capture market share. The company has announce plans to divest this business unit

WD-40 has seen growth across all regions it operates in, with the Asia-Pacific (APAC) region showing the highest CAGR at +5%, followed by the Americas at 4.4%, and Europe, the Middle East, and Africa (EMEA) at 2.6%. The growth in the APAC region can be largely attributed to increasing urbanization. According to the World Bank, China's urban population grew from 55% to 66% between 2014 and 2023, while India's urban population increased from 32% to 36% during the same period. This urbanization trend has likely spurred demand for WD-40's products, as more urban dwellers take on home maintenance and DIY projects.

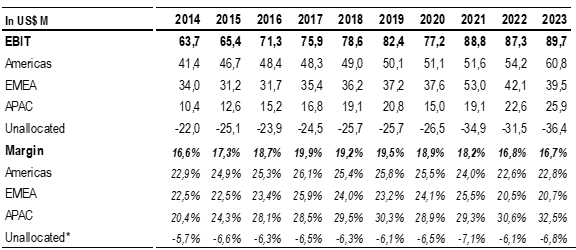

In 2023, WD-40's EBIT margin stood at 16.7%, approximately 3 percentage points lower than its pre-COVID peak of nearly 20%. This decline in profitability is primarily attributed to increased costs of finished products. The company notes that two petroleum-based inputs and tin plate cans constitute 67% of the total unit cost for WD-40. Post-COVID supply chain constraints and the war in Ukraine have driven up prices for tin and oil, impacting the company's cost structure.

Profitability varies at regional level. In the Americas and EMEA EBIT margin is 22,8% and 20,7% respectively while in the APAC region is much higher at 32,5%. The gap might be explained in the way WD-40 approach the market in each region. In the Americas and EMEA WD-40 is more involved in the distribution as it leases and operates warehouses where it store products ready to fulfill costumer orders. While int eh APC regions the operations is purely commercial while all the warehousing and distribution might be in the customers hands.

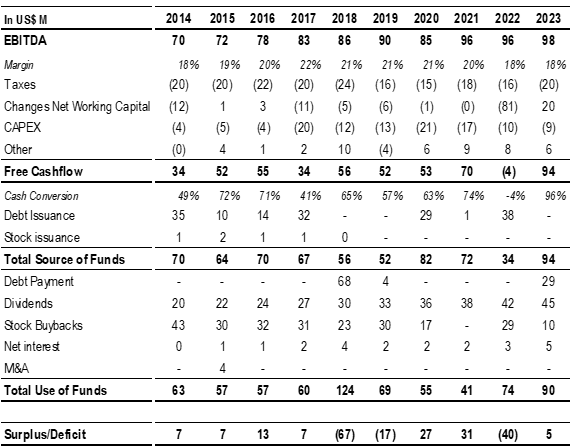

WD-40 has maintained an average cash conversion rate of 60% of EBITDA (calculated as free cash flow divided by EBITDA) over the past decade. Free cash flow has increased from $34 million in 2014 to $94 million. While the company typically has low working capital requirements, it increased its inventory levels in 2022 to secure raw materials and finished products, mitigating the risk of supply chain disruptions.

Capital expenditure (CAPEX) requirements have remained relatively low, ranging from 1-3% of revenue. The company has effectively utilized free cash flow to reduce debt, pay dividends, and repurchase shares. Since 2014, WD-40 has repurchased more than $250 million in stock and returned over $360 million in dividends to shareholders. This prudent financial management has allowed the company to maintain a solid financial position while rewarding shareholders.

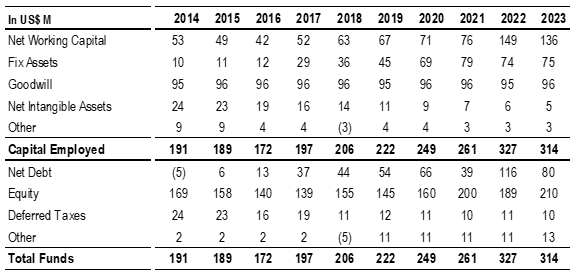

WD-40's capital employed reached $314 million in 2023. Of this, $136 million (42%) is attributed to net working capital, followed by goodwill and intangibles at 31%, and fixed assets at 23%. The predominance of working capital is due to the company's organic growth strategy, minimal acquisition activity, low fixed asset requirements, and higher inventory levels maintained to counter supply chain constraints.

WD-40 has traditionally funded its capital needs primarily through equity, maintaining a conservative capital structure. The company's debt constitutes approximately 25% of its capital structure, resulting in a leverage ratio of 0.8x EBITDA. This conservative leverage level indicates a strong balance sheet and a prudent approach to financial management, allowing the company to maintain financial flexibility and stability.

Valuation

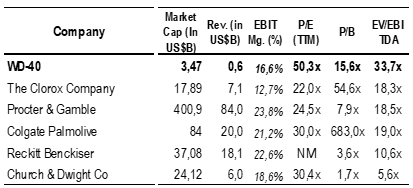

WD-40's stock price has risen in recent months, driven by the company's strong performance and optimism about avoiding a recession. However, when compared to other consumer staples, the stock appears overvalued based on several key valuation metrics.

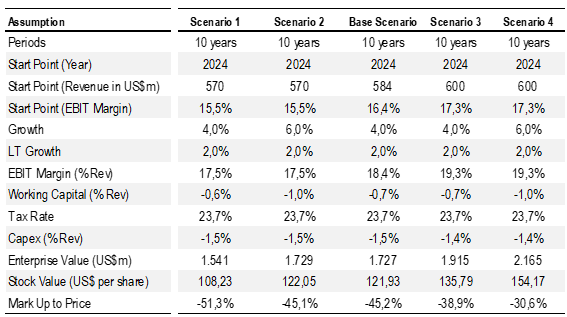

Our assessment suggests that the fair value of WD-40's stock is approximately $142 per share, which represents a 43,1% discount to its current market price. This valuation is derived from discounted cash flow models across several scenarios, based on the following assumptions:

2024 guidance: We anticipate that WD-40's revenue for 2024 will be in the range of $570-600 million, in line with the company's guidance. We expect an EBIT margin of approximately 16-17% for the year.

Revenue Growth: We project revenue growth in the range of 4-6%, driven by the company's market opportunities in the Asia-Pacific (APAC) region and the continued popularity of DIY (do-it-yourself) and ready-to-assemble furniture trends.

EBIT Margin Improvement: We expect EBIT margins to improve to around 17.5-19.3%, supported by the normalization of raw material costs, price increases, and operational efficiencies. The company has already announced a gross margin improvement of 2 percentage points, from 53% to 55%.

APAC Market Dynamics: In high-growth environments fueled by increased market share in the APAC region, we anticipate a decrease in EBIT margins to levels similar to other regions. This may occur if the company shifts from a full-commercial model to a distribution-focused one.

Brazilian Acquisition Impact: We do not expect any significant margin dilution from the recent Brazilian acquisition, as its impact on overall results is minimal.

Working Capital: We expect working capital to normalize, with inventories returning to historical levels of around 10% of revenue.

Tax and CAPEX: We have set the income tax rate at 23%, assuming it will remain stable, though future changes in U.S. fiscal policy and corporate tax rates remain uncertain. CAPEX is expected to stay stable at 1.4-1.5% of revenue.

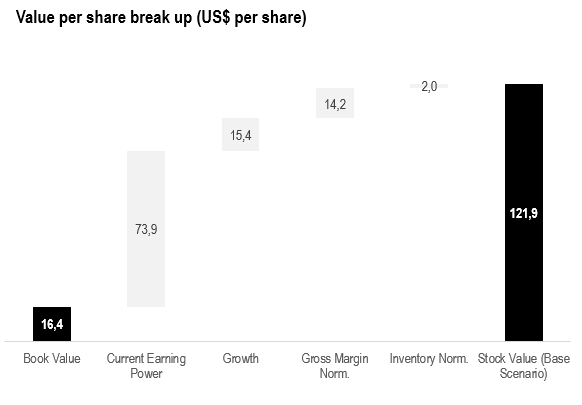

Breaking down the value creation drivers, it becomes clear that a significant portion of the stock's value relies on the company's ability to sustain long-term growth and enhance its current profitability, while most of its value comes form the existent earning power achieved by it current brand recognition.

The DCF valuation further supports the view that the stock is overvalued. To justify its current price, WD-40 would need to achieve higher levels of growth and profitability that are inconsistent with its historical performance. Additionally our valuation put the enterprise value to be around 16x EBITDA, a ratio closer to the pricing of other consumer staple companies

Risks

Our current DCF valuation incorporates various growth scenarios under a going-concern assumption. However, we recognize that our valuation could be impacted by the following factors:

Dependence on Core Product Line: WD-40's revenue is heavily reliant on its core product family. According to the company, 81% of its maintenance product revenue comes from WD-40 Multi-Use Product, and 13% from WD-40 Specialist. There is uncertainty around whether future competitive pressures could erode the market share of the WD-40 product family, which would significantly affect the company's growth and margins.

Potential Sale of Home Care and Cleaning Products: Our valuation scenarios do not account for the potential sale of WD-40's "Home Care and Cleaning Products" segment. The impact of such a sale is uncertain, as the potential value, terms, and its effect on the company’s capital structure are currently unknown.

Uncertainty in Margin Improvements: Our valuation assumes certain margin improvements; however, if these improvements are not realized or fall short of expectations, we estimate that our stock valuation could decline by approximately 11%.

Disclaimer: I want to emphasize that up to the publication of this post, I have closed all my positions in WD-40. However, it's crucial to understand that my personal investment choices should not be considered as a recommendation or endorsement for others to follow suit. All investment decisions carry inherent risks, and past performance is not a guarantee of future results. Before making any investment decisions, please acknowledge the necessity of seeking guidance from a qualified financial advisor and carefully assessing your individual financial situation, risk tolerance, and investment objectives. The information provided here is for informational purposes only, and I am aware that there is no assurance of its accuracy or completeness.

Download the PDF report here