Update: Taking losses on Perion Network

On why I close my position

A few days ago I published my case for Perion Network even though I had been holding the stock for almost half a year. Taking losses on stocks is never easy but as “taking profits” is sometimes needed. At the end is not only about knowing what to buy but also knowing when to sell.

What I like about Perion has not changed

When I first discovered Perion, I was immediately drawn to its foundation in relentless innovation within the realm of new technologies. Positioned as a vital support system for the burgeoning digital marketing industry, Perion embodied what I refer to as a "company behind a company," nurturing the growth of this emerging sector.

The company's prospects appeared exceptionally promising, mirroring the upward trajectory of digital marketing's share of marketing budgets, which showed no signs of slowing down. Projections indicated a sustained double-digit growth in the years to come, further enhancing Perion's appeal.

From a financial standpoint, Perion exhibited remarkable growth, a trend it seemed to sustain even through turbulent times. Notably, it boasted a debt-free status and a substantial cash reserve, earmarked for both future expansion and rewarding shareholders.

These enduring characteristics remained steadfast, and ordinarily, I would have confidently maintained my investment in the company. However, recent circumstances have prompted a reevaluation of my stance

So I made my assumptions

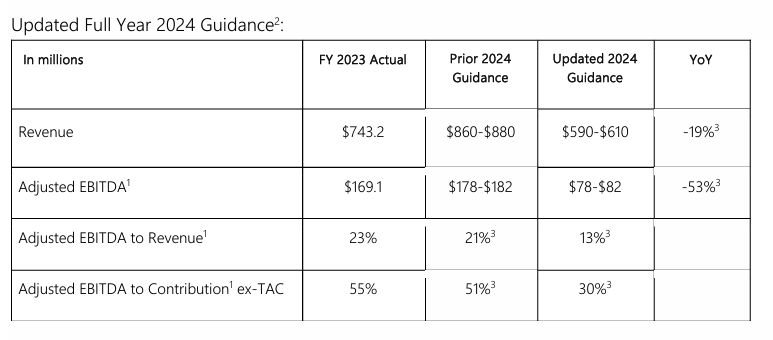

Taking a cue from the scenario where Perion closed FY24 with a commendable revenue of US$850 million and an 18% AEBITDA, which neatly aligned with the company's guidance, I projected a base case with a 12% growth trajectory in the subsequent years. This projection factored in significant margin improvements as Perion capitalized on operational leverage. My other scenarios assume a lower growth and lower margins.

Based on this analysis, my average valuation for the company stood at a robust US$32 per stock. Despite the stock price taking a hit due to a gloomier economic outlook and geopolitical tensions arising from the conflict in Israel, I anticipated a promising markup on the stock.

But then reality hit

The company release a preliminary financial result stating the following:

In the first quarter of 2024, Perion experienced a decline in Search Advertising activity, attributable to changes in advertising pricing and mechanisms implemented by Microsoft Bing in its Search Distribution marketplace. These adjustments led to a reduction in Revenue Per Thousand Impressions (RPM) for both Perion and other Microsoft Bing distribution partners. These changes contributed to decreased search volume.

The decision by Perion to drastically revise its FY24 guidance, slashing revenue projections from the initially anticipated range of US$860-880 million to a significantly lower US$590-610 million, coupled with a reduction in AEBITDA from 21% to 13%, sent shockwaves through the market. The magnitude of this downward adjustment had a profound and immediate impact on investor sentiment, resulting in a staggering 40% loss in the company's total market capitalization.

Given the stark shift in Perion's outlook and the substantial downward revision in its guidance, I promptly revisited my valuation assumptions to reflect the new circumstances. After careful analysis, it became evident that even under the most optimistic scenario, the stock might only be valued at US$25 per share, resulting in no profit at all based on my initial investment.

Recognizing the significant deviation from my earlier projections and the unfavorable risk-return profile, I made the decision to close my position in Perion. While it's disappointing to exit without realizing a profit, prioritizing capital preservation in light of the revised outlook is essential to safeguarding investment interests and managing risk exposure effectively.

Lessons to be learned

When it comes to forecasting, it's important to recognize that no one possesses a crystal ball. Unexpected developments can swiftly reshape the business landscape, whether due to fluctuating customer preferences, market dynamics, or unforeseen events like supply chain disruptions or regulatory changes. While it's natural to rely on certain assumptions in our analysis, it's equally crucial to acknowledge the inherent uncertainty and variability in the business environment.

In hindsight, I realize I may have become overly confident in Perion's reliance on Bing for its search business. While partnerships with industry giants like Microsoft may seem stable, it's essential to factor in the possibility of adverse scenarios, including significant downside risks. In today's climate, where scrutiny over the dominance of big tech firms is heightened, no company is immune to potential disruptions or shifts in market dynamics.

Disclaimer: I want to emphasize that up to the publication of this post, I DO NOT hold a position in Perion Networks. However, it's crucial to understand that my personal investment choices should not be considered as a recommendation or endorsement for others to follow suit. All investment decisions carry inherent risks, and past performance is not a guarantee of future results. Before making any investment decisions, please acknowledge the necessity of seeking guidance from a qualified financial advisor and carefully assessing your individual financial situation, risk tolerance, and investment objectives. The information provided here is for informational purposes only, and I am aware that there is no assurance of its accuracy or completeness.