Copa Airlines: Panama´s hidden gem

Commercial airtraveling is usually a bad business. Not for Copa

Summary

Unique Business Model with Strong Competitive Moat: Copa Airlines leverages its hub-and-spoke model centered in Panama City, using its geographic advantage at Tocumen International Airport to efficiently connect 80+ destinations across the Americas. Its efficient operations, standardized fleet, and combination of low-cost carrier discipline with legacy service quality create strong barriers to entry for competitors.

Consistent Financial Outperformance: Over the past decade, Copa has delivered steady revenue growth (4.9% CAGR) driven by rising passenger traffic and moderate fare increases. EBIT margin has nearly doubled from 11.8% in 2015 to 21.8% in 2024, supported by strong operating leverage, disciplined cost control, and pricing power on key routes.

Robust Cash Generation and Conservative Balance Sheet: The airline generates $300–450 million in free cash flow annually, fueled by profitability and customer prepayments. Its strong cash flows have funded fleet expansion while maintaining one of the lowest debt levels in the industry (debt at 78% of equity), providing ample financial flexibility.

Growth Opportunities and Strategic Expansion: While growth beyond its Panama hub is structurally limited due to regional challenges (infrastructure, regulation, macro volatility), Copa is expanding into low-cost markets via its Wingo subsidiary to capture additional demand in price-sensitive segments, leveraging Copa’s operational backbone while mitigating typical low-cost carrier risks.

Attractive Valuation with Upside Potential: Despite strong performance, Copa trades at a significant discount (6.3x FWD P/E) versus peers like LATAM (10x) and Delta (8x), offering over 40% potential upside to an estimated fair value of $150 per share. Key risks include fuel price volatility, macroeconomic headwinds, and increased competition or regulatory changes, though Copa’s strong margins and conservative financial position provide a margin of safety.

About Copa Airlines

Copa Airlines, the national carrier of Panama, is a premier airline in Latin America with a reputation for punctuality, efficiency, and regional connectivity. Founded in 1947, the airline operates over 100 Boeing aircraft and serves more than 80 destinations across the Americas and the Caribbean. Its strategic hub at Tocumen International Airport in Panama City allows Copa to offer a wide range of direct and connecting flights, making it a critical player in the region’s air travel infrastructure.

The airline’s business model revolves around a hub-and-spoke system, capitalizing on Panama’s geographic advantage to efficiently link major and secondary cities across the continent. Copa combines the efficiency of a low-cost carrier with the service quality of a legacy airline by maintaining a standardized fleet, optimizing operations, and controlling costs. The company also operates Wingo, a low-cost subsidiary targeting price-sensitive customers in Colombia and other Latin American markets, enabling Copa to tap into the growing demand for affordable air travel.

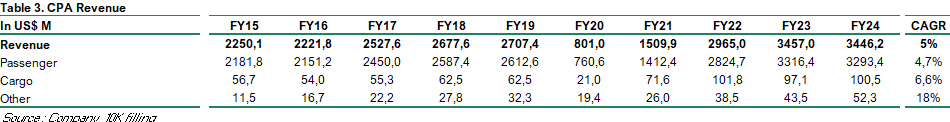

Revenue-wise, Copa is heavily reliant on passenger transportation, which accounted for approximately 88% of its $3.54 billion total revenue in 2023. Cargo services contributed the remaining 12%, highlighting the company’s secondary focus on freight. Geographically, about 72% of its revenue came from Latin America, followed by 18% from North America and 10% from the Caribbean. This balanced revenue mix reflects Copa’s strong market positioning and its ability to serve a broad and diverse customer base throughout the region.

Strategic Advantage: The Power of Panama

Copa’s hub-and-spoke model, combined with its unique geographic location, creates strong competitive advantages and generates consistent value. This strategic positioning has translated into a steady improvement in the company’s return on invested capital (ROIC), which rose from 13.6% in 2015 to an impressive 19.9% in 2025.

Tocumen International Airport—located at the narrowest point between North and South America—serves as an ideal connecting hub, enabling seamless travel between continents with short connection times and minimal operational bottlenecks. The efficiency of this model, along with low airport congestion and streamlined customs, sets Copa apart from its peers. As a result, Copa consistently ranks among the world’s most profitable airlines, with an EBIT margin of 22.7%, far surpassing regional competitors like LATAM, Delta, and Air Canada.Furthermore, the airline was among the fastest to recover post-COVID, quickly restoring capacity and profitability thanks to its lean cost structure, agile operations, and resilient demand network.

Replicating Copa’s model would be extremely difficult for other airlines, as it would require not only building the necessary fleet scale and route network, but also developing the operational expertise, infrastructure, and bilateral traffic rights that Copa has carefully constructed over decades. Its geographic monopoly at Tocumen, combined with its deep integration into the region’s air travel ecosystem, gives Copa a durable moat that few competitors can match.

Limitations to Growth Beyond the Hub

Despite its strategic strengths and operational efficiency, Copa faces meaningful challenges when it comes to expanding beyond its geographic core. While the Latin American commercial aviation market is expected to grow at a modest 4% CAGR in the coming years, that pace lags behind other emerging regions such as Southeast Asia (projected at 6.8%) and Africa (5.6%). Several structural headwinds weigh on the region's growth potential: underdeveloped airport infrastructure in many countries, burdensome regulatory environments, high air travel taxes, and a history of macroeconomic volatility that limits consumer demand. Political instability and fluctuating currencies further complicate cross-border operations. As a result, although Copa has crafted a highly profitable model within its core geography, replicating that success on a broader regional or global scale will require navigating a complex web of structural limitations and slower market dynamics.

To address these limitations and unlock new growth avenues, Copa is investing in capacity expansion through its low-cost subsidiary, Wingo. This strategic move allows the company to target underserved and price-sensitive segments across Latin America, particularly in secondary cities and leisure-heavy routes where traditional Copa service may be less viable. By operating with a lean cost structure and a more flexible business model, Wingo can stimulate demand in slower-growing markets while extending Copa’s footprint beyond its Panama hub. Importantly, the low-cost strategy enables Copa to add additional local and regional point-to-point routes that complement its existing network, leveraging Copa’s operational expertise, maintenance infrastructure, and management systems.

However, operating a low-cost carrier in Latin America comes with unique challenges. Unlike in North America or Europe, where ultra-low-cost models thrive, South and Central America pose barriers such as high airport fees, limited access to secondary airports, inconsistent government regulation, and expensive fuel due to import and tax structures. Moreover, the fragmented nature of the region—with multiple small countries, currency volatility, and political risk—makes network planning and cost control significantly harder. These constraints have led to the failure or scaling back of several low-cost entrants over the years. Wingo’s ability to operate efficiently within this difficult environment—while leveraging Copa’s back-end capabilities—gives the group a meaningful edge in capturing underserved demand without the risks that typically burden standalone low-cost operators in the region.

Ownership Structure and Management

Copa Holdings operates under a dual-class share structure, consisting of Class A and Class B shares. Class A shares are publicly traded and widely held by global institutional and retail investors, while Class B shares carry enhanced voting rights and are primarily held by Panamanian stakeholders, including members of the founding management and affiliated business groups. This structure enables Copa to access international capital while maintaining local strategic oversight.

Importantly, Class B shareholders not only provide long-term governance continuity but also support Copa through favorable commercial relationships. Some of these shareholders are affiliated with companies that serve Copa under competitive terms—most notably Banco General and Petroleos Delta, which respectively provide financial services and fuel supply, among other such as insurance, legal sercvices, real estate,etc. These partnerships contribute to Copa’s cost efficiency and operational reliability by aligning supplier interests with those of the airline. As a result, Copa benefits from a unique ecosystem of aligned stakeholders that enhances its competitiveness and financial resilience.

The airline is led by Pedro Heilbron, who has served as CEO for over 20 years and is widely credited with transforming Copa into one of the world’s most profitable carriers. His leadership emphasizes strict cost discipline, network efficiency, and sustainable value creation.

Financial Performance

Copa Airlines reported $3.5 billion in revenue in 2024, reflecting a compound annual growth rate (CAGR) of 4.9% over the past ten years. This steady expansion underscores the strength of Copa’s business model and its ability to thrive in a challenging region. Revenue growth has been primarily driven by a consistent increase in passenger traffic, as well as moderate fare increases, enabled by network optimization and disciplined capacity management. These operational gains were supported by favorable macroeconomic conditions across several Latin American markets, including rising middle-class consumption, improved regional trade flows, and a gradual recovery in business travel post-pandemic.

Several economic tailwinds have supported Copa’s top-line performance. Countries like Panama, Colombia, and the Dominican Republic—key nodes in Copa’s network—have experienced stronger GDP growth and expanding tourism sectors, which contributed to rising demand for both leisure and business travel. Additionally, currency stabilization in core markets during much of the post-COVID period helped reduce volatility in international ticket pricing and boosted consumer purchasing power. The airline also benefited from lower relative inflation in Panama, which operates under a dollarized economy, giving Copa a more stable cost and revenue base compared to regional peers.

As the company managed to grow revenue, it also significantly improved its profitability metrics. Copa’s EBIT margin rose from 11.8% in 2015 to 21.8% in 2024, nearly doubling over the decade. This improvement reflects strong operating leverage, as fixed costs were spread over higher traffic volumes, and pricing power, particularly on strategically important routes. The airline’s disciplined cost structure, high aircraft utilization, and efficient hub operations contributed to maintaining low unit costs while supporting fare increases. This dual focus on volume and yield has enabled Copa to deliver one of the most robust margin profiles in the global airline industry.

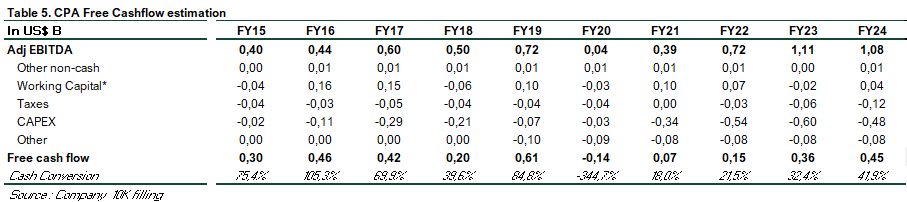

Copa Airlines has consistently delivered strong and stable free cash flow, generating between $300 million and $450 million annually over the past decade. This performance has been primarily driven by rising profitability and, like most airlines, by customer prepayments—cash received in advance from ticket sales prior to the actual flight. These prepayments provide a natural source of short-term liquidity and are a structural advantage in the airline business model, helping to smooth out working capital needs and support ongoing operations.

Improved operating margins and strict cost control have further enhanced Copa’s cash flow profile, enabling it to fund much of its growth internally. However, this strong inflow has been partially offset by increasing capital expenditures (CAPEX) as the company ramps up investment in new aircraft and infrastructure to expand its capacity and modernize its fleet. The need to remain competitive and fuel growth has led Copa to allocate significant resources toward long-term strategic assets.

Copa’s strong cash generation has also enabled the company to maintain a conservative and healthy capital structure. As of 2024, Copa holds approximately $1 billion in total debt, representing just 78% of its equity—one of the lowest leverage ratios in the global airline industry. This prudent financial position provides the company with significant flexibility to weather economic downturns, manage fuel price volatility, and invest opportunistically in fleet and network expansion. The low debt burden also translates into reduced interest expenses, further supporting Copa’s profitability and free cash flow generation.

Outlook and Valuation

Copa Airlines entered 2025 with solid operational momentum, as evidenced by its Q1 results, which highlighted a nearly 10% increase in capacity year-over-year. However, revenue growth remained essentially flat, weighed down by a 9% decline in unit revenue (RASM)—a reflection of pricing pressure in certain markets and tougher year-over-year comparisons. Despite these headwinds, operating margin remained strong at nearly 24%, only 1 basis point below last year, supported by ongoing cost efficiency and lower fuel prices in the quarter.

Looking ahead, we expect a stronger second half of the year, particularly in Q3 and Q4, as seasonal demand picks up and pricing conditions normalize. Copa’s robust network, disciplined capacity deployment, and ongoing operational reliability should allow it to capture recovering traffic and stabilize yields. Based on these assumptions, we forecast full-year 2025 revenue to reach approximately $3.6 billion, reflecting modest growth from 2024. Profitability is also expected to remain healthy, with an EBIT margin of around 22%, assuming fuel costs remain within the mid-range of historical averages.

Following the release of its Q1 results, Copa’s stock price responded positively, reflecting investor confidence in the company’s solid operational execution and long-term prospects. The stock is currently up 18% year-to-date, demonstrating strong momentum despite broader concerns over the aviation sector. However, even after this impressive rally, Copa’s valuation remains highly attractive, especially when compared to both regional and global peers, and considering its superior financial and operational performance.

On a forward price-to-earnings (P/E) basis, Copa trades at 6.3x forward earnings, which represents a significant discount to the broader airline industry average of 21x. When compared to direct competitors, the discount remains evident, with LATAM trading at 10x and Delta at 8x forward earnings. This valuation gap is particularly notable given Copa’s industry-leading EBIT margins, strong free cash flow generation, low leverage, and consistent capital returns. In our view, this disconnect offers a compelling investment opportunity.

We estimate that Copa shares should be valued at approximately $150 per share, implying an upside potential of over 40% from current levels. Our valuation assumptions are based on the following:

Revenue Growth Scenarios

In our base case, we expect Copa to maintain top-line growth of approximately 4% per year, broadly in line with expected growth rates for Central American commercial aviation, which is projected to expand at a moderate pace as the region continues its gradual economic development.

In a more optimistic scenario, where Copa accelerates its expansion through its low-cost carrier strategy, we assume annual revenue growth could range between 6% and 10%, driven by additional market penetration, increased frequencies on existing routes, and access to new customer segments, particularly in price-sensitive regional markets.Profitability Outlook

Starting from an already high EBIT margin of 22%, we assume that, under the base scenario, Copa will achieve gradual margin improvement over time, primarily supported by operating leverage as fixed costs are spread over a growing revenue base.

However, under the low-cost expansion scenario, while growth would be higher, we factor in some margin compression due to lower unit revenues and higher competitive pressures typical of low-cost models, especially in price-sensitive markets where cost advantages may narrow.Working Capital and Capital Expenditures

We expect Copa to continue benefiting from positive working capital dynamics, driven by its business model of collecting cash upfront from advanced ticket sales—a structural liquidity advantage in the airline industry.

In terms of capital expenditures, we forecast ongoing CAPEX requirements at approximately 14% of sales, reflecting continued investments in fleet renewal, capacity expansion, and infrastructure upgrades necessary to support both growth scenarios while maintaining high service standards.

Risks

The major risks to our valuation are centered around fuel price volatility, which remains one of the most significant cost drivers for Copa Airlines. Currently, fuel expenses account for approximately 30% of revenue, with historical fluctuations ranging between 20% and 30% of total sales. A significant increase in fuel prices would inevitably pressure margins. The actual impact would depend on the airline’s ability to pass higher fuel costs onto customers through ticket price increases. In scenarios where price adjustments are possible, growth could be constrained as higher fares may dampen demand. Alternatively, if Copa is unable to fully pass on these costs, profitability would be directly affected. Nevertheless, given Copa’s strong margins and disciplined cost structure, we believe there remains a margin of safety under both outcomes.

A second key risk is a potential global or regional economic slowdown, particularly if high interest rates and inflation continue to weigh on consumer spending. In such a scenario, discretionary expenditures like air travel could be among the first to decline, especially in Latin America where disposable incomes remain sensitive to macroeconomic cycles. Lower demand would affect both passenger volumes and pricing power, putting additional pressure on revenue and profitability.

A third risk involves increased regional competition and potential regulatory changes. While Copa currently enjoys significant competitive advantages due to its hub positioning and efficient operations, new entrants—particularly government-supported carriers or aggressive low-cost competitors—could erode market share or drive down fares. Additionally, changes in aviation regulations, bilateral agreements, or taxation policies across key Latin American markets could introduce new operational challenges or cost pressures that may affect Copa's long-term strategic positioning and financial performance.

Disclaimer: Up to the publication of this post, we have an open a long positions in Copa Airline. However, it's crucial to understand that our investment choices should not be considered as a recommendation or endorsement for others to follow suit. All investment decisions carry inherent risks, and past performance is not a guarantee of future results. Before making any investment decisions, please acknowledge the necessity of seeking guidance from a qualified financial advisor and carefully assessing your individual financial situation, risk tolerance, and investment objectives. The information provided here is for informational purposes only, and I am aware that there is no assurance of its accuracy or completeness.

![[100+] Copa Airlines Wallpapers | Wallpapers.com [100+] Copa Airlines Wallpapers | Wallpapers.com](https://substackcdn.com/image/fetch/$s_!a3BE!,w_1456,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F0aea1c28-4351-408d-8e1a-2c55b6fc701a_1200x800.jpeg)